USD: The Best Stable Coin!

USD: The Best Stable Coin!

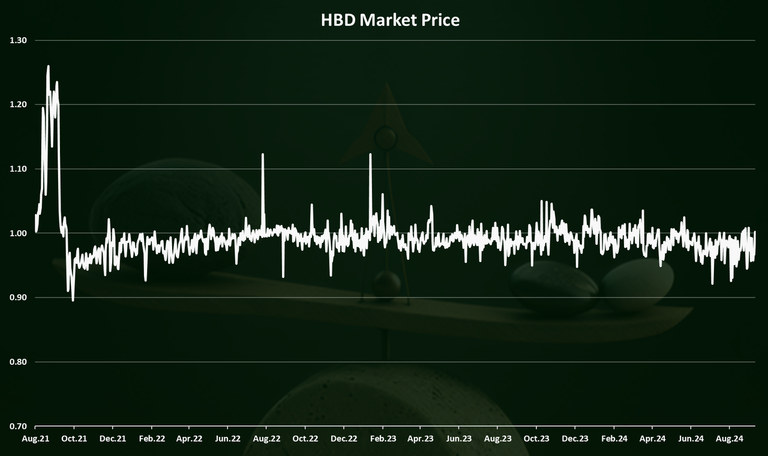

This is a favorite topic of mine. It got triggered again by reading one of the latest post by @dalz about HBD. It is a very detailed post about the inner workings of HBDStabilizer. If anyone is interested in the inner working of hive economy, I highly recommend the post. This current writing, however, is not about that, it will draw from a chart of HBD that dalz shared. I am posting that below the DXY chart.

Search for a Stable Coin

In Crypto it is a thing, we all know that. The reasons are many fold:

- Most popular crypto project and their governance coins are volatile

- A lot of the world can't easily own USD digitally

- It is better to price a product in a currency that doesn't move too much

There are many other reasons, but these three readily comes to mind. Take Splinterlands for example:

Can you imagine what would happen if they priced cards in anything other than USD?

The project would be dead by now.

Also we know the demise of Luna, and it was an algo stable coin. If you don't remember the details do a basic search on Luna. Since HBD is an algo stable coin, I had this common argument with people that HBD is dangerous and not stable. Well at least over the last 4 years it has been stable. Infact a lot more stable than USD (represented by DXY), and that is saying something!

My affection with USD

This is also my pet peeve, and I have been given hard time on this from many angels. So, please look at the first chart of DXY. The US Dollar Index (DXY) is calculated as a geometrical average based on its six constituent currencies: Euro, Japanese Yen, British Pound Sterling, Canadian Dollar, Swedish Krona, and Swiss Franc.

It is a weighted geometric mean of the dollar's value relative to following select currencies:

Euro (EUR), 57.6% weight

Japanese yen (JPY), 13.6% weight

Pound sterling (GBP), 11.9% weight

Canadian dollar (CAD), 9.1% weight

Swedish krona (SEK), 4.2% weight

Swiss franc (CHF), 3.6% weight

That first image again is the long term chart of DXY, each bar is 1 month, and it spans 1976 to present and beyond. I started trading in the nineties. During that time, and through the 2000s, there was a common and popular thesis that US Dollar has no where to go but down. Many reasons were shown historically:

- US trade deficit

- Inflationary monetary policy by the US FED

- Rise of Euro as a currency

- General hate against US dominance

- Rise of the BRIC nations as a economic superpower

Again, there were many others. Loaded with this solid thesis, many investors, throughout the late nineties and early 2000s positioned themselves into various anti-dollar assets. Gold, Long Euro, International Real Estate, BRIC stocks, later BTC to name a few. The investment thesis was so populat back then (and even now) that several respected investors, even Warren Buffet, shorted the Dollar. Over the next tens of years, in the 2010s, 2020s; that trade mostly didn't work out. Buffet lost $4B on the short dollar trade, one of the biggest losses, if not the biggest, in his impeccable and coveted investing career!

Mind you these are long term bets and spans tens of years. For me I have always been bullish on USD. Coming from India, it helped me to understand the status on the ground in the "developing world". It is not that the thesis against the dollar was wrong, in fact all the bullets that I listed, are true. However, that is not the problem. The reason the USD shines, because the alternatives are as bad or worse. So world didn't really have a choice, so they held unto US dollar, because what else are you going to hold?

EURO? LOL, it is struggling to remain as an union. With massive pressure from the illigal immigration from the Africa and Middle East conflicts, and negative native birth rate, it is losing its financial power every day!

BRIC Nations? That story is dead in Brazil. Russia is effectively behind Iron Curtain. India is struggling with inflation at a much higher rate than US. China's growth has stalled and effectively at trade war with US!

Gold? Well there is a thesis there, but honestly most of the demand is from India, which continue to hold, but can't really overtake the inflation in India

International Real Estate? Well, Latin America is toast, people from there are buying property in the US. Europe is overpriced and unsafe for investment. There are pockets in Asia that remain good, but can't keep up with demand

BTC? Well this is not my intention to say it, but I got to be realist. We are still new and people don't take us seriously, and for good reason. If you disagree, that is a separate post!

So there you have it. There is no other game in town. So USD shines!

On the first chart again, I have drawn my working career. Current and projected. This is the time measured in 30 years! Hopefully I won't be working till 2037!! However, during this entire time USD rallied. It is no stablecoin internationally. It almost performed as a value stock!! So majority of my assets remained in USD and I have done really well on this investment thesis. Even if USD does poorly in the next 10 years (which has a very very low chance of happening) and DXY drops, I don't think it will drop below the green arrow. And that my friends is my life-long speculation!!

Despite my involvement in crypto, I am one of those who thinks traditional investments are still important. Including having cash on hand in case of an emergency. I don't think that is going to change for a long long time.

Yes I agree. I don't see cash replacements anytime soon. Perhaps not in the next 20 years

1985 must have been the height of the US economy cause what kind of cliff is that?😂😂

I didn't know that people were going short on USD or it was viewed as an unstable coin😂😂😂

You make valid points here though, despite the US economy being shitty, I don't see anyone doing mich better...

Euro which is viewed by almost all as their rivals in my view is on the brink of collapse with the way things ate going...

maybe this long term chart of US interest rates will give you answers.

That's a lot of panic and depression 😂

Well such is life in financial markets

But still, the money printers are working, inflation will be even higher, debt increasing and the US needs to pay more and more interest on this, so the only option is to rise the debt ceiling and keep printing to pay and on and on, imo the financial system as a whole is broken, it has been going downhill since they stopped with the backing of gold, this can't go on forever.

I agree with you, the alternatives have problems too, I'm in the Euro zone, imo the northern euro country's should have a separate coin, there are just too much differences between north and south countries and economy's

All the negative thesis against the USD is correct, however, that is not the reason. People just do not understand that there are few alternatives.

Since you are in Europe, I hope you can see the problem by looking at this chart.

Well, if you can find Europe on this chart

Yeah, fertility rates here have been falling since 1960 (I had to use google for this but it's an interesting topic). With the high African and Middle East immigrant heres, who DO get a lot more children than the Europeans there's won't be many left in the future that's for sure.

In terms of holding I would say:

So far BTC vs USD looks pretty good:

Yes, nothing wrong with US real estate, just need a good entry which is my local area is a lot below

That has always pretty much been my understanding as well. It calls to mind Churchill's famous statement about Capitalism: "It's a terrible system, but it's better than anything else"

Yes most Americans living overseas or who have spent significant time overseas understand this reality easily.

Some others don't, but I call that ignorance or denial.

Of all the fiat currencies out there, USD is the predator and will eat the rest over time. As other fiat currencies fail they will flee to the USD. But BTC is the top of the food chain and eventually people will flee to it.

First part of your statement I agree with. I also agree with the hypothesis the people with weak native currency will fall for crypto. We have seen this happen already with Venezuela, Nigeria, Argentina, Bangladesh, Pakistan, Indonesia etc. However they won’t flock to BTC as it’s not really a currency. It doesn’t have transaction capacity in terms of speed and cost anymore. That’s why people need to find something else. There lies the hope. Cheap, free, zero transaction fee something ;)

HIVE ❤️

I am glad someone got the clue.

Always paying attention when someone mentions 'Pakistan.' It helps grow the community and discover new Hivers. Everyone needs a helping hand in their early days on Hive.

Don't get me wrong, I enjoy Hive but everything goes to zero against BTC in the long run. Maybe I should frame it as store of value instead of currency as I'm sure other crypto (including Hive) will start to become more relevant in that area in the short-medium term.

I again agree with that sentiment. Yet I say, BTC is not a currency, it is a store of value. Nobody buys a cup of coffee with BTC anymore and if they do that’s unfortunate. There are numerous coins that can act as currency

Hive also does something completely different than BTC. It has blogging, socials, games, etc - not a direct apples to apples comparison on my part.