Inverted Yield Curves

Inverted yield curves usually signal a recession but it's weird with the current US economy because we are actually witnessing a stable, roaring economy although the curve is inverted. like the s&p 500, dow jones, etc are hitting all time highs

the risk of a recession occuring is present but the likelyhood of it happening is quite low.

people are questioning whether the US economy is way ahead of current fiscal/monetary policies because this is unusual

an argument is that the introduction of advanced technology, the AI boom, is really what is keeping the economy afloat

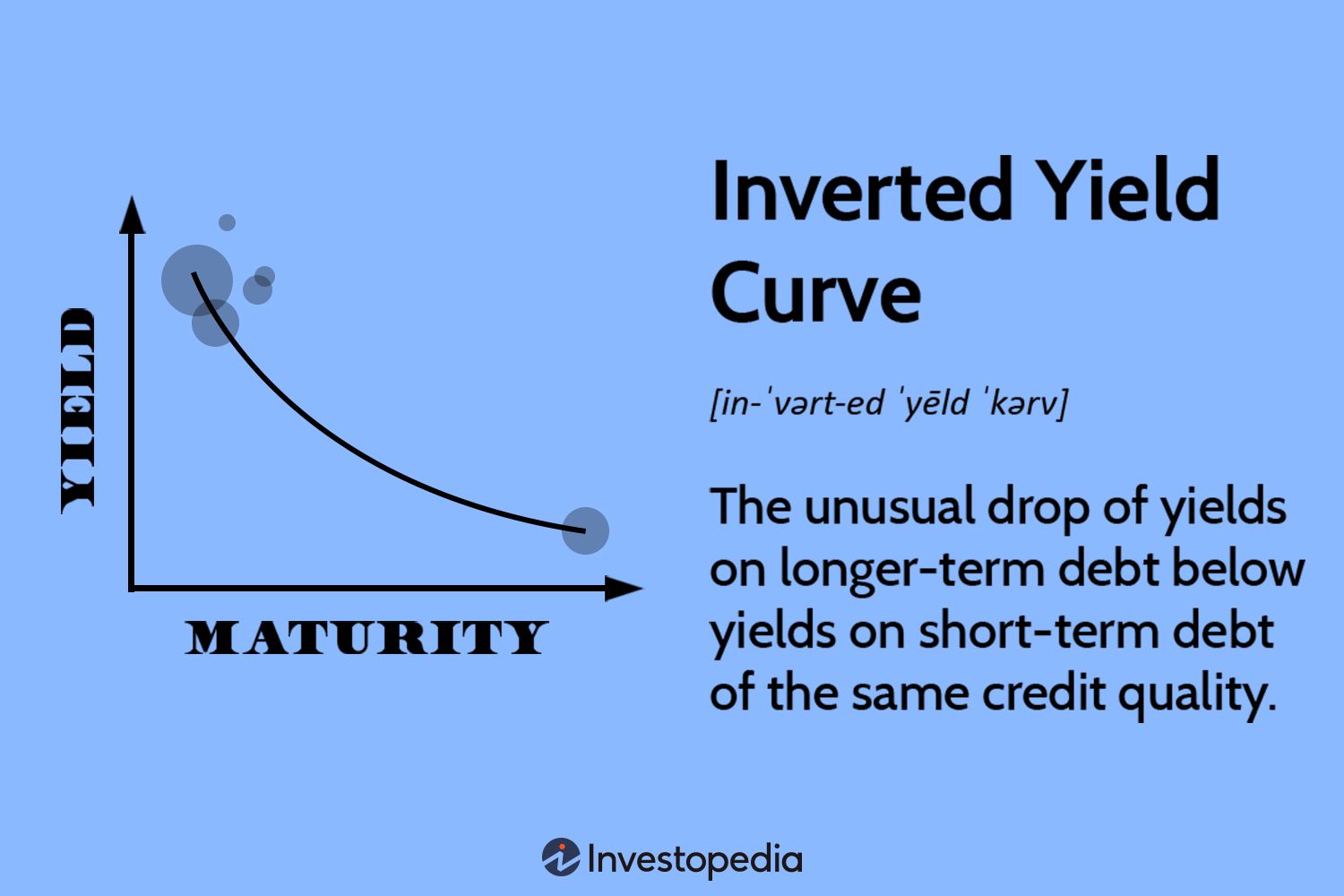

just to help you understand further, the yield is where individuals profit from, higher the yield, the higher the return. i believe the yield curve although inverted right now is slowy going to become flat when the fed goes on with the rate cycle

as you can see, you could get high returns currently from short term bonds because the inverted yield is higher from 0-5 years.

since the curve might get flatter in the future, and when the fed cuts rates, the 10-30, more the 15-30 year end of the curve will have a lower yield than currently. this is why some asset management firms like blackrock for example is pushing towards longer maturity bond holdings to secure current higher yields.

sure you could profit a ton from short term bonds right now but you need to think ahead ofc.