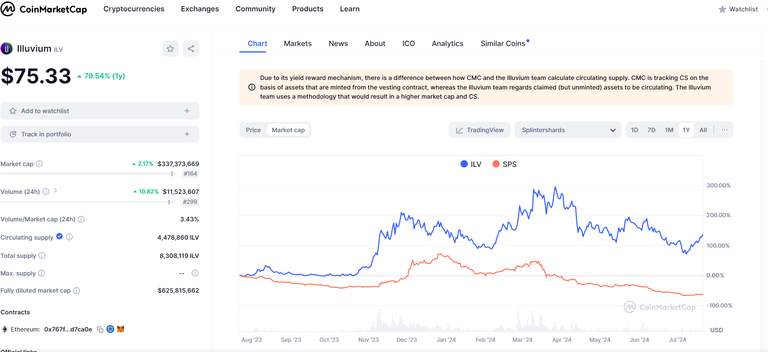

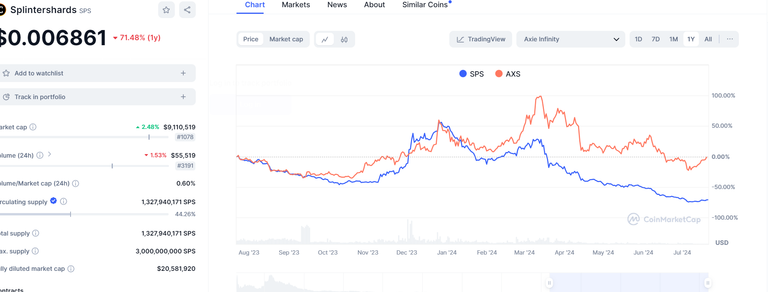

SPS compared to TLM, AXS and other gaming tokens over one year

Below are a bunch of charts that show the market cap performance of SPS vs other gaming tokens in the web3 space and comparing the overall market caps assuming you staked for the entire 1 year period to get the real performance of each token compared to SPS.

ILV performed by far way better than SPS outshining it by about 150% this year if you had bought and staked ILV VS SPS at the beginning of the year. Also having ILV in LPS would have likely yielded pretty high ROIs as the asset has overall increased and when paired with ETH it would have generated nice trading fees as well as increases in price on both assets which would enhance the overall returns.

TLM performed about 100% over SPS over a one year period as well and up until lately has been underperforming SPS but it looks to have had a recent spike to which SPS did not take part in where most of the market followed BTC and ETH with price increases like TLM had a almost 50% price increase while SPS remained flat.

DEC would have been a great option for those who acquired DEC on its lows and sold at its highs for USDC then bought back on lows again and kept doing that which would have been a overall more profitable strategy than holding SPS and any excess returns could have been used to buy SPS using DEC after it has been held in say land and keep staking and unstaking DEC from land buying and selling using the normal range of DEC fluctuations to set buy and sell orders as well as liquidity in the DEC-USDC LP to earn fees over the entire typical range. Also renting out assets for DEC is likely a better strategy for many as then they never need to buy into a set full boar to compete at the highest levels they can just buy packs using HIVE and SPL income retained to buy cards at bid as well as bid on packs to open and the keep any good cards that can be rented out for a high price and sell off any cards that are not good for renting or playing or for land and use the DEC to purchase more packs to open. One of the main things is finding leg gold foil cards to put on land for really cheap if you can get a little bit of luck when buying CL or other packs. It may may make sense to start adding one sided orders for SPS on BSC in USDC so that if SPS Spikes down I can hopefully catch the spike down pull my liquidity and then stake my SPS to rent out for DEC as I do not think its worth staking the additional SPS beyond a certain point as the extra SPS does less for you in terms of rewards and to maximize it I need to find the point where the SPS is more effective being rented out and just collecting staking rewards in DEC to then use to buy SPS when SPS is down and DEC is up and vice versa when DEC is down and SPS is not down as much or up buy DEC and wait for the DEC increase in its range then repeat.

IMX one of the key players in gaming for blockchain and web 3 and I see it as more of a infrastructure play to bet on the IMX ecosystem being able to keep the current games and attract more with is low low fees and its evm compatibility which is super important to expand on other chains. IMX if you had staked it or held it if there is not staking yet would have performed about 200% better maybe a little less than SPS over the one year period where SPS declined for most of the year with a few months in the beg of the year before the many announcements about the company and all of that which has caused a shake out in the game of many larger players that do not want to take any more risk as well as many players lowering there risk to SPL at the moment myself included, well I already lowered my risk a while ago and have done so on every pump up of prices by selling into the pump and projecting based on a inflation adjusted basis where the ATH would be if it were today and todays number of tokens and I would ball park it at .05-.1 where we would get back to a 100-200 million market cap for the game and would be a good 10 to 20X from the current prices. If SPL is successful with its turn around plans then the first day it becomes apparent that they are going 100% in the right direction or some catalyst comes along like a significant investor or partnership that have been boosts for other games as they now have the funding SPL needs and if we get the funding it is not likely that any of the same mistakes will be made as we should be in a much better position right now but some of the moves made by the previous structure of the organization like expanding way to fast into like 3-4 new games when the first one did not have all of the promises delivered or on track. Peoples capital has been tied up in land for years as it has for other things which basically made SPS inflation much worse as people would just sell the SPS as there wasnt much else to do with it at the time as it didnt mean anything but staking rewards and when those started to just decrease over and over again due to the DAO not brining in value for unit holders but putting out additional tokens which just gives us more tokens and has no impact on market cap so we really should be worried about getting revenue in for the token as well as getting positive price action through some marketing and hype where the DAO can use some of its SPS to cash into stables and other reserve assets that will allow it to fund things and be much more powerful.

If the SPS DAO can get a increased treasury of base cash flow that it knows it will have every day without much change it can plan much more effectively and budget a lot better to cover expenses and buyback tokens to burn so that SPS gets a much higher value as there will be tokens burned meaning the current value will increase as there will be less inflation and dilution in the future once they are burned.

AXIE Infinity and RONIN chain are also a comparable project to splinterlands and there chain RON has outperformed SPS by over 300% and there in game token which is the reward token also broke even and at one point pumped to a 75% ish gain above SPS and it wasn't until later in the year around the march time frame when the company announced some catalysts that likely caused SPS to perform worse than AXIE as AXIE has a lot more backing and funding from deep pocketed investors and right now Splinterlands does not have such funding as if it did it would likely be able to make some serious moves especially if HIVE is not interested in helping support us staying on the HIVE chain maybe there is a opportunity to move to a different chain with a grant from such chains foundations etc. Many chains are giving out grants to build on there chain to grow the assets on chain and this may be a chance for SPL to get funds to not only stay on HIVE ideally but also find a way to be multi chain with HIVE which would be a good way to benefit hive by having SPL if it can get a grant to build out onto another chain and bridge users to hive and also the other way as well and both ecosystems will do better as people will likely venture into HIVE if they are using the blogging earnings or HP rental income to purchase assets in game like many do as it is one of the only ways to also get your HIVE and other HIVE layer twos converted to SPS or DEC to bridge off SPL and onto BSC where the in game currencies can be cashed in for more blue chip assets. If you add more ways to bridge hive onto EVM compatible chains HIVE could expand using SPL as one of the methods it makes its presence on other chains known as maybe SPL could use HIVE on the other chains as some of its main trading pairs so that people will wonder what hive is so maybe they could have a DEC/HIVE and DEC/HBD as well as SPS/HBD and SPS/HIVE. HIVE could also expand its reach by creating integrations with other web 3 social media platforms and also get on board with potentially doing a airdrop of HIVE and SPS for doing certain social tasks promoting both HIVE on x chain and SPL on x chain which benefits both parties. SPL could be a great marketing tool to expand HIVEs user base and HIVE it self could use a huge influx of users as users that are active are probably very small and most have things automated to get x HIVE via curation trails or vote bots like splinterboost that also votes on delegators posts so I just delegate to Splinterboost get 8-9% in HIVE which the APR fluctuates based on HIVEs price as 8-9% now may be 24-36% if prices go back to .5 plus range for all earnings now. Also any time hive has a significant increase it might be a good idea to buy DEC depending on where it is in the cycle or swap into HBD if you can get it on the markets cheaper than doing the conversion with the stabilizer as you can likely get HBD much cheaper and below peg at times and then hold it in savings until hive takes a dump and sell it for hive slowly at peg or higher and if its a big drop then maybe just sell HBD and take the slippage if it means getting a lot more HIVE that will increase your influence and vote income. Also posting the same content on steem and self voting along with buying votes as well as the use of AI to write a ton of articles is a good way to generate additional revenue as well as using AI to write comments to peoples posts by pasting the post and telling it to comment on the post in a certain way and make various comments be generic enough for certain topics over time where you can have a data bank of them and have a chat bot linked to a steem account that automatically answers questions and comments on peoples posts for additional votes and follows. If one were to do this with thousands of posts and make sure that the AI responses are reasonable, short and persuade people to follow you and upvote your content then the following should build and to do that on steem and other platforms so that I can use techniques that are banned by the people that do it anyway on HIVE an just utilize those techniques else where to bring in more revenue to use some to acquire HIVE when its price is low giving me increasing vote power and when I get enough using that model to expand the operations on to many many similar platforms and recycle the original content posted on HIVE via a AI generator for the others as well as utilize a generative image AI, generative music AI as well as voice and video to create various channels and blogs that go after posting, commenting, interacting with key members as well as forming a multi platform curation project where the HIVE tokens sold get people a revenue share of 95% of HIVE income which will be a combination of posting, curation, delegation to splinterboost or other bots, delegation to rent it out at 10% plus as well. Then the revenue share of 10% of all other income will be given out on top of normal curation rewards from typical curation trails. Over all the curation rewards should be higher than what any service can offer once expanded onto other social media web 3 platforms that reward there users like hive and steem. Also looking for airdrops of tokens for these platforms with no token yet may be a good strategy for example DBank a social platform that tracks assets and pays you for your contribution to the news feed by posting articles etc has XP points that can also be earned along with the cash and those will be for a future airdrop of its own token.