SPLINTERLANDS: Doubling down on SPS! [LIQUIDITY POOL]

To begin with:

What follows is not intended as financial advice. Of course.

SPS testing new lows

This week saw SPS testing new lows before finding a fragile equilibrium at $0.11.

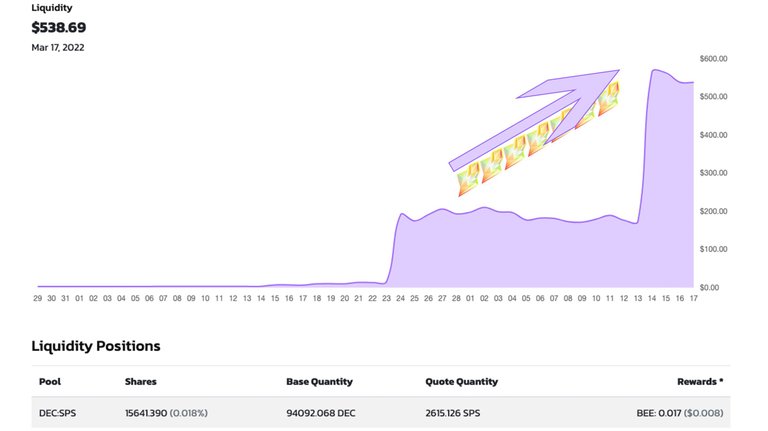

I took it as an opportunity to increase my stack of SPS by adding $400 dollars in a DEC:SPS liquidity pool (half DEC/half SPS).

At the time of writing, I roughly get 20 SPS daily by combining the airdrop with the staking. At a value of $0.11, this represents $2.2 per day.

Here is a quick breakdown of my current stake in SPS:

| My current position |

|---|

| 0.14 * $200 (full SPS) |

| 0.12 * $180 (half DEC / half SPS → Liquidity Pool) |

| 0.11 * $400 (half DEC / half SPS → Liquidity Pool) |

| Average cost: < $0.12 |

In Splinterlands, I consider myself as an investor first, a player second. Still, I do spend huge amounts of time playing the game. It is enjoyable and I do wish to climb the leagues season after season.

Nevertheless, the money I inject into the game usually directly goes to SPS as it seems like the team is trying to drive as much utility as possible to their governance token.

SPS is my "high risk / high reward" type of bet. Being aware of the risks involved, I do not invest more than I am willing to lose while making sure that I have other "safer" bigger investments on the side.

I know that the crypto community is very fond of YOLO stories (I enjoy them too!), but I'd better not risk what I do need for what I don't need. As Warren Buffett said, that would be foolish.

My wife and I are working hard to build the life we want in the very near future, so it would simply be extremely disrespectful and irresponsible to put that at risk. Consequently, my way of growing my deck is to constantly reinvest all my earnings from the ecosystem into buying more cards.

I've recently reached the important threshold of 15k+ Collection Power, which would allow me to play in, at least, Silver III even if my rentals get cancelled. That was important to me.

Risks inherent to Liquidity Pools

Impermanent Loss: HODL VS POOL

From my understanding, impermanent loss is the opportunity cost that could result from contributing to a liquidity pool instead of simply hodling the tokens.

In the case you would have been better off just by hodling the tokens, that would mean that you suffered from impermanent loss. The term "impermanent" can be misleading because those losses are very real the day you get your money out of the pool.

Again, from what I understand (please, feel free to correct me or add more depth to my thinking if needed, I'll appreciate), as long as the two tokens in the pools see their variations in price highly correlated, the impermanent loss is minimal.

Impermanent loss can be quite dramatic when the two tokens are no longer going in the same direction. You'll then "exchange" the more valuable token for the one less valuable, which means you will end up with more of the less desirable token.

In the case of SPS and DEC

Holding DEC is a somewhat dangerous endeavor as it was originally pegged at $0.001 (it is today at x3 the peg). However, since DEC has been designed as the easiest way to boost a player's SPS airdrop, its price has been highly correlated to the other token of the game.

Therefore, for the foreseeable future, a decent guess would be that those two tokens will be evolving in the same direction. That being said, the risky part is what will happen once the whales decide to dump their DEC in anticipation of the end of the airdrop?

I don't mind having a small amount of DEC at the end to purchase a few cards off the market. However, I would naturally prefer to convert as much of it as possible into SPS. To do so, I plan on "dollar-cost averaging out" of my liquidity pool position if that makes any sense.

As I have no idea when the biggest whales will start making moves, getting out of my position in small chunks seems to be a decent strategy (unless everybody adopts that same strategy). By doing so, I'll purposefully give up on maximizing my SPS airdrop though.

Let me know what you think!

I would love to get insight on this topic from more experienced players as I've been playing the game for only four months or so.

Congratulations @tt88! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 2000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!